Customer cohort analysis is all about grouping your users based on a shared characteristic—most often, when they signed up—and then tracking how they behave over time. Instead of just looking at broad, often misleading, business averages, this method gets to the true story behind your customer retention and engagement.

Think of it like studying a high school graduating class. You wouldn't just look at the average income of all alumni from the past 50 years. You’d follow the Class of 2014, the Class of 2015, and so on, to see how their careers progress years after they walked the stage together. That’s cohort analysis in a nutshell.

Let's say your e-commerce store brought in 1,000 new customers last month. A standard report might tell you your overall repeat purchase rate is 20%. That number gives you a snapshot, but it hides the critical details that actually matter.

What if 50% of customers from your new influencer campaign made a second purchase, while only 5% of those who came from a discount-heavy ad campaign ever came back? That blended average of 20% masks both a huge win and a significant red flag.

This is exactly the problem that customer cohort analysis solves. It stops you from making decisions based on data that smooths over the peaks and valleys of real user behavior. By sorting users into "cohorts," you can finally compare apples to apples and uncover insights you can act on.

By looking at specific groups, you move from asking, "What is our retention rate?" to "Which customers have the best retention rate, and why?" This shift is the foundation of a truly data-driven growth strategy.

To really get a handle on this, it helps to break down the core components that make up any cohort analysis. These are the building blocks you'll use to understand your customer behavior.

With these elements, you can build a clear picture of how different groups of customers behave long after their first interaction with your brand.

The most common starting point is the acquisition cohort, which simply groups users based on when they joined your world.

For example:

By tracking these groups separately, you can see how things like product updates, marketing campaigns, or even seasonality affect long-term customer value. Did that big website redesign you launched in March lead to higher retention for the "March 2024" cohort compared to previous months? Answering that question suddenly becomes straightforward.

This is where cohort analysis really shines for marketers. It’s a powerful tool for understanding campaign effectiveness and boosting customer lifetime value. By segmenting customers by their acquisition channel—like direct traffic versus a specific paid ad campaign—you can analyze retention rates within these distinct groups.

You might find that customers acquired through direct traffic show much higher retention and loyalty than those who came from certain paid ads. That's a game-changing insight. It helps you pour your marketing budget into the channels that attract users who are more likely to stick around for the long haul.

This level of detail is fundamental for smart resource allocation. It tells you which channels aren't just driving one-off conversions but are bringing in valuable customers. This ties directly into the bigger picture of marketing success, which is where understanding the importance of attribution models in marketing becomes crucial for seeing how every touchpoint contributes.

Ultimately, cohort analysis transforms your data from a simple rearview mirror into a predictive map for sustainable growth.

So, you understand the power of grouping customers. What's next? Knowing what to actually measure. Averages can be incredibly deceptive, but the right metrics within a customer cohort analysis framework act as a diagnostic tool, revealing the true health of your business.

Without them, you’re just staring at a spreadsheet full of data. With them, you’re uncovering strategic direction.

These metrics aren't just numbers on a dashboard; they're the vital signs of your customer base. They help you answer critical questions like, "Are our new customers sticking around?" and "Which marketing channels are bringing in the most profitable users over the long haul?"

Let’s break down the essential KPIs that turn raw cohort data into powerful, actionable insights.

Customer Retention Rate is arguably the most fundamental cohort metric you can track. It measures the percentage of customers from an initial group who are still active in the following weeks or months. Think of it as a loyalty scorecard for each specific batch of users you acquire.

Instead of one single, company-wide retention number, you get a dynamic, evolving picture. For instance, you might see your "January" cohort has a 60% retention rate after three months. But your "February" cohort, acquired during a new product launch, boasts a 75% rate. That immediately tells you the launch had a positive, lasting impact on how "sticky" your product is.

Key questions retention rate helps you answer:

This is where cohort analysis gets incredibly powerful for your bottom line. Tracking Customer Lifetime Value (LTV) by cohort shows you exactly how much revenue each group of customers generates over their entire relationship with your brand.

This metric moves you beyond just the initial purchase to reveal the true financial impact of your acquisition strategies.

For example, a Facebook ad campaign might bring in customers with a low initial cost per acquisition (CPA). But a cohort analysis could reveal their LTV is a measly $50. Meanwhile, customers from organic search might have a higher CPA but an LTV of $250. Without cohort analysis, you might mistakenly pour more money into the lower-value Facebook campaign.

By tracking LTV by cohort, you connect your marketing spend directly to long-term profitability, not just immediate conversions. It’s the difference between finding cheap customers and finding valuable ones.

Churn Rate is the flip side of retention. It measures the percentage of customers from a cohort who leave during a specific period. Analyzing churn by cohort helps you pinpoint exactly when and why customers are abandoning your product or service.

Is there a specific month where users tend to drop off? Maybe Month 3 is a critical period where the initial excitement wears off. If you notice the "April" cohort has an unusually high churn rate in its first month, you can immediately investigate what happened in April. Was it a buggy software update? A confusing new feature? A competitor's massive promotional campaign?

This level of detail allows you to be proactive, not reactive. You can introduce targeted interventions, like an educational email campaign or a special offer, for cohorts as they approach that critical drop-off point. It helps you find the leaks in your customer journey so you can patch them for good.

Identifying these patterns is a huge first step. For a deeper dive, you can learn more about how to measure marketing attribution to connect churn back to the specific touchpoints that caused it.

Theory is one thing, but rolling up your sleeves and doing your first customer cohort analysis is where the real learning begins. The good news? The process is more straightforward than it sounds, and you definitely don't need a degree in data science. It’s all about asking the right questions and systematically finding the answers in your data.

This step-by-step guide will walk you through the framework, turning those abstract concepts into a practical, repeatable process. We'll demystify the steps so you can move from a sea of numbers to actionable insights with total confidence.

Before you even think about touching your data, you have to know what problem you're trying to solve. Without a clear goal, you’ll just be swimming in numbers, hoping to bump into an insight. A focused question is your compass—it guides the entire analysis.

Start with a specific business challenge you're facing. For instance:

A precise question is your best defense against analysis paralysis. It ensures your findings are directly tied to a business outcome you can act on.

Once you have your question, it's time to wrangle the data. At a bare minimum, you’ll need two key pieces of information for every single user:

From there, you’ll pull the data for the specific metric you plan to track over time, whether that's subsequent purchase dates, login activity, or subscription renewals.

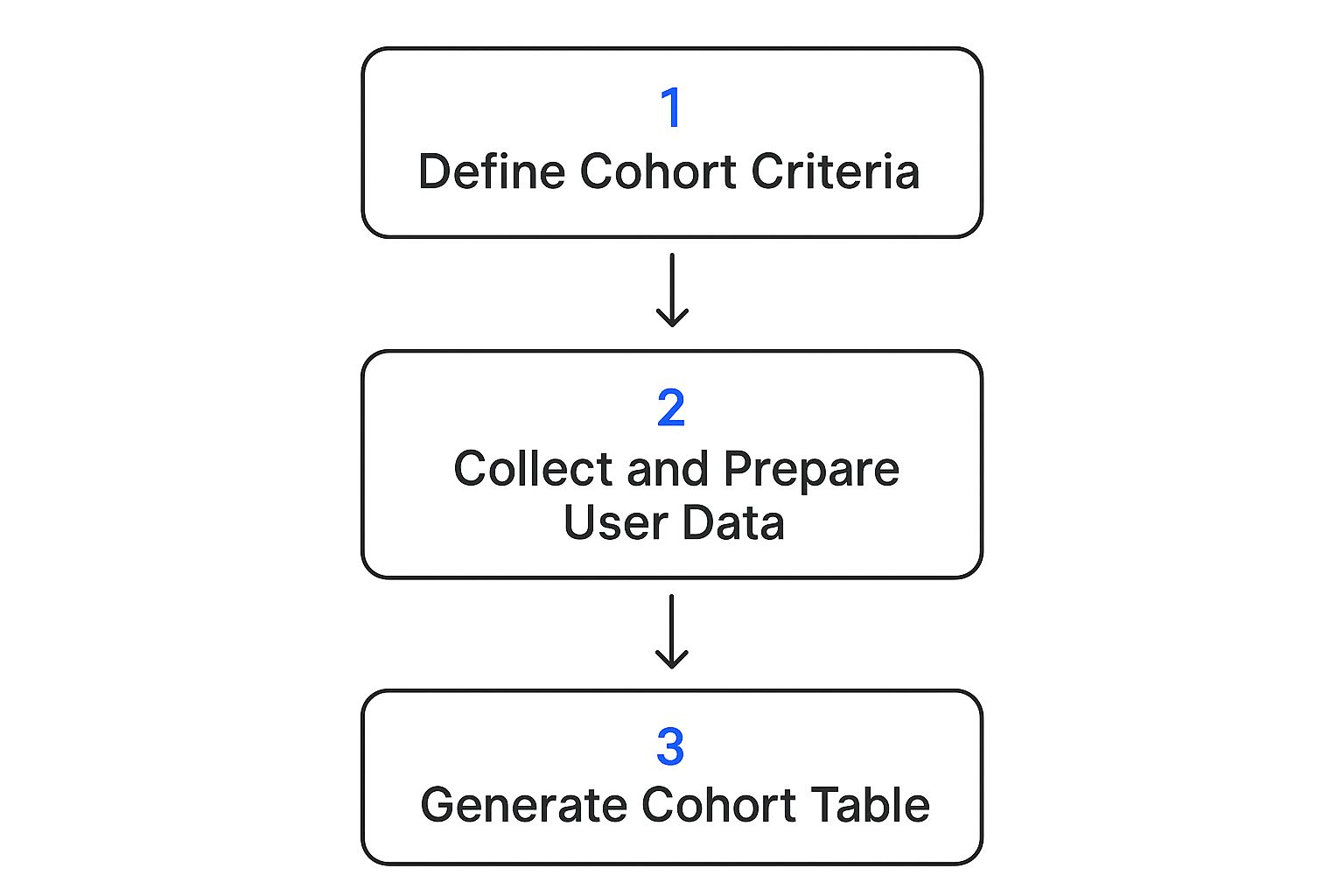

This infographic breaks down the fundamental workflow for getting your data ready.

This flow—from defining criteria to generating a visual table—is the backbone of any successful customer cohort analysis.

With your data organized, the next move is to make it visual. The classic way to do this is with a cohort chart, which often looks like a "heat map." This table format is the industry standard for a reason: it makes trends and patterns instantly visible.

Here’s a quick guide on how to read one:

The colors in a heat map give you a quick visual cheat sheet. Darker colors often mean higher values (like better retention), letting you spot high-performing cohorts or major drop-off points with just a glance. A good cohort chart transforms a raw spreadsheet of dates and numbers into a compelling story about your customer lifecycle. It shows you not just what is happening, but when.

This is it—the final and most crucial step. You have to interpret your findings and decide what to do next. An insight is only valuable if it leads to a concrete action.

Let's say your analysis shows that the "March" cohort—acquired from a new influencer campaign—has a 20% higher retention rate than any other group. The action is clear: dig into what made that campaign so successful and figure out how to replicate it. This process often involves a closer look at different revenue attribution models to understand which touchpoints truly drove that valuable behavior.

On the flip side, if a cohort shows a steep drop-off after the first month, your action is to investigate your onboarding process or the initial product experience for that group. Was there a bug? A confusing feature launch? Answering these questions is what turns your customer cohort analysis from a historical report into a forward-looking strategic tool.

Theory and metrics are one thing, but the true power of customer cohort analysis really comes alive when you see it in the wild. Abstract concepts suddenly click into place when they’re used to solve real-world business problems. To bridge that gap, let's walk through a few stories from different industries where cohort analysis was more than just a report—it was a catalyst for growth.

These examples show how businesses, from e-commerce stores to SaaS platforms, use cohort data to answer their most pressing questions. They reveal what’s truly possible when you stop looking at blended averages and start listening to the distinct stories your customer groups are telling you.

Picture an online fashion retailer selling everything from casual t-shirts to high-end leather jackets. The marketing team was wrestling with a classic problem: which products were the best "gateway" items? They needed to know which first purchases led to loyal, high-spending customers. So, they ran a behavioral cohort analysis, grouping customers not by when they joined, but by the category of their very first purchase.

The results were eye-opening:

This single insight completely reshaped their marketing strategy. They shifted ad spend to feature leather jackets not just as a product, but as an entry point into their premium brand experience. This strategic pivot, driven entirely by cohort data, directly increased their overall customer lifetime value.

A growing B2B SaaS company was gearing up for a crucial round of funding. Investors weren't just interested in their current monthly recurring revenue (MRR); they wanted to see proof of a sustainable, sticky business model. A single, blended retention number just wasn't going to cut it. The founders used acquisition cohort analysis to build a powerful story.

They presented a cohort chart showing the net revenue retention of every quarterly acquisition cohort for the past three years. This one visual instantly proved that newer cohorts weren't just churning less—they were also expanding their accounts at a much faster rate than older cohorts. It was clear evidence that their product improvements and customer success efforts were having a direct, positive financial impact.

Instead of just saying, "Our product is getting better," they showed it with data. The "November 2023" cohort had a 115% net revenue retention after one year, meaning it was generating more revenue than it did initially. This story of accelerating value was far more compelling to investors than a simple top-line revenue graph.

A mobile gaming studio was pouring millions into user acquisition across various ad networks. On the surface, it looked like a success, but the finance team was getting nervous. They needed to know which campaigns were bringing in valuable players versus "one-and-done" installers. This is the same challenge e-commerce brands face when trying to identify which campaigns attract loyal repeat buyers, where a 10-30% boost in repeat purchases is often achievable with the right insights.

The studio created cohorts based on the acquisition channel. They tracked key metrics like Day 7 retention, average in-app purchase value, and the time it took to make the first purchase. The analysis quickly uncovered that one ad network, despite having a high cost-per-install, delivered a cohort of players who spent 300% more over their lifetime.

This allowed the team to confidently scale the budget for that "expensive" channel while cutting spend on others that brought in low-value users. By connecting acquisition source to long-term behavior, they dramatically improved their return on ad spend. Fully understanding how to track the customer journey from first click to final conversion is key to replicating this kind of success.

Discovering a powerful insight with customer cohort analysis is a great feeling, but it’s only half the battle. Let’s be honest: raw data and colorful charts don’t improve your bottom line on their own. The real value comes when you turn those findings into decisive, strategic actions that actually drive growth.

Analysis without action is just an academic exercise. This is where you connect the dots between what the data says and what your business does next. When you uncover a pattern—good or bad—it’s a clear signal to investigate, learn, and adapt your strategy.

Imagine your cohort analysis reveals that customers acquired from a specific ad campaign in May churned at an alarming rate after just one month. A standard churn report would have buried this detail, but cohort analysis puts it right under a microscope. Now you have a clear starting point for your investigation.

The question isn’t just what happened, but why. The issue could stem from a few common culprits:

By isolating the problem to a specific cohort, you can focus your diagnostic efforts instead of guessing what's wrong with your entire customer journey. A critical part of this is understanding lead attribution to confirm if the initial touchpoint was truly the root of the problem.

Your cohort data is a goldmine for your product team. It provides an unbiased look at how real users interact with your product over time, showing you where they find value and where they get stuck. By analyzing behavioral cohorts, you can move beyond simply reacting to feature requests and start making data-driven product improvements.

For example, if you see that cohorts who use a specific feature within their first week have a 30% higher retention rate, that’s a powerful signal. It tells your product team two things:

This approach turns product development from a guessing game into a strategic function aimed squarely at boosting key business metrics.

A cohort chart is more than a retention report; it’s a roadmap for your product team. Every drop-off point is an opportunity to improve the user experience and build a stickier product.

Ultimately, the goal is to create a feedback loop where insights from your customer cohort analysis continuously inform every growth-focused team in your organization. This data can empower multiple departments to make much smarter decisions.

This strategic application is especially crucial in the SaaS world. When preparing for major financial events like an IPO, companies rely on cohort analysis to prove sustainable growth to investors. Reporting these metrics in SEC filings has become a standard practice to demonstrate a healthy, predictable revenue model.

Once you start exploring customer cohort analysis, you're bound to have some questions. It's an incredibly powerful method, but knowing how to approach it—from picking the right tools to understanding its finer points—is what turns raw data into game-changing insights.

Think of this section as your go-to guide for all those "what ifs" and "how-tos" that pop up. We'll give you clear, straightforward answers to the most common questions we hear, so you can skip the guesswork and start making smarter decisions right away.

This is probably the most common question we get, and the distinction is critical. While both methods group customers, they answer very different questions about your business.

Customer segmentation is like taking a quick snapshot of your entire customer base. It groups people based on static attributes or what they're doing right now. For example:

Segmentation tells you who your customers are at this moment. You might create a segment of "VIPs" who have spent over $500 in total. This is perfect for targeting them with a special offer.

Customer cohort analysis, on the other hand, is more like watching a movie. It's dynamic and tracks groups of people over time based on a shared starting point. The most common cohort is based on an acquisition date—for example, everyone who signed up in January. The analysis then follows that group to see how their behavior evolves month after month.

Segmentation gives you a static picture of "who," while cohort analysis provides a dynamic story of "how behavior changes over time." You need both, but they serve fundamentally different purposes.

The best tool for you really depends on your scale, technical comfort, and what you're trying to figure out. The good news? You don't need a massive, expensive platform to get your feet wet.

Here’s a look at your options, from the simplest to the most advanced:

There’s no magic number here. The best approach is to establish a regular rhythm for check-ins while also running analyses whenever something significant happens.

Running an analysis at these times tells you the direct consequences of your actions on long-term user behavior and retention.

Getting started with customer cohort analysis is exciting, but a few common slip-ups can lead to misleading conclusions. Keep these in mind to save yourself a lot of headaches.

By steering clear of these pitfalls, you can ensure your analysis gives you a clear, accurate, and actionable view of your customer lifecycle.

Ready to stop guessing and start knowing exactly which marketing efforts are driving long-term, valuable customers? Cometly unifies all your data to give you crystal-clear attribution and powerful cohort insights. See how you can optimize your ad spend and scale with confidence. Get started with Cometly today!

Learn how Cometly can help you pinpoint channels driving revenue.

.svg)

Network with the top performance marketers in the industry