Customer lifetime value analysis is all about predicting the total profit you'll earn from your entire relationship with a customer. It’s a shift in focus—moving away from short-term wins, like a single sale, to the long-term health and profitability of your customer base. This change in perspective is absolutely essential for building a business that lasts.

Think about your business like a garden. You could spend all your energy planting crops that give you one quick meal and then die off. Or, you could cultivate perennial plants that come back stronger and yield a harvest season after season. That's the real difference between chasing one-time sales and truly understanding customer lifetime value (CLV).

CLV analysis isn't just another number for your analytics team to track. It's a completely new way to look at your entire growth strategy. It forces you to ask a tough but critical question: are you acquiring customers who buy once and vanish, or are you building relationships that deliver compounding returns over time?

When you move from a transaction-focused mindset to a value-focused one, it changes everything. Prioritizing CLV naturally pushes you to concentrate on what actually matters for sustainable success.

This lens helps you:

By focusing on the long-term relationship, customer lifetime value analysis turns marketing from a cost center into a strategic investment in future revenue. It forces you to build a better business, one that customers want to stick with.

Finding and nurturing these high-value segments is where the magic really happens. In fact, research shows that companies who excel at personalization generate 40% more revenue than their competitors.

This is often because a small, dedicated group—sometimes just 20% of customers—can drive up to 80% of your total revenue. The old 80/20 rule is alive and well.

Ultimately, CLV analysis is about building a more resilient and profitable company. It shows you where to invest your resources and pushes you to create exceptional experiences that customers love. This approach not only boosts your bottom line but also builds a much stronger brand.

For a deeper dive, check out our guide on https://www.cometly.com/post/10-proven-customer-retention-strategies-for-saas-companies.

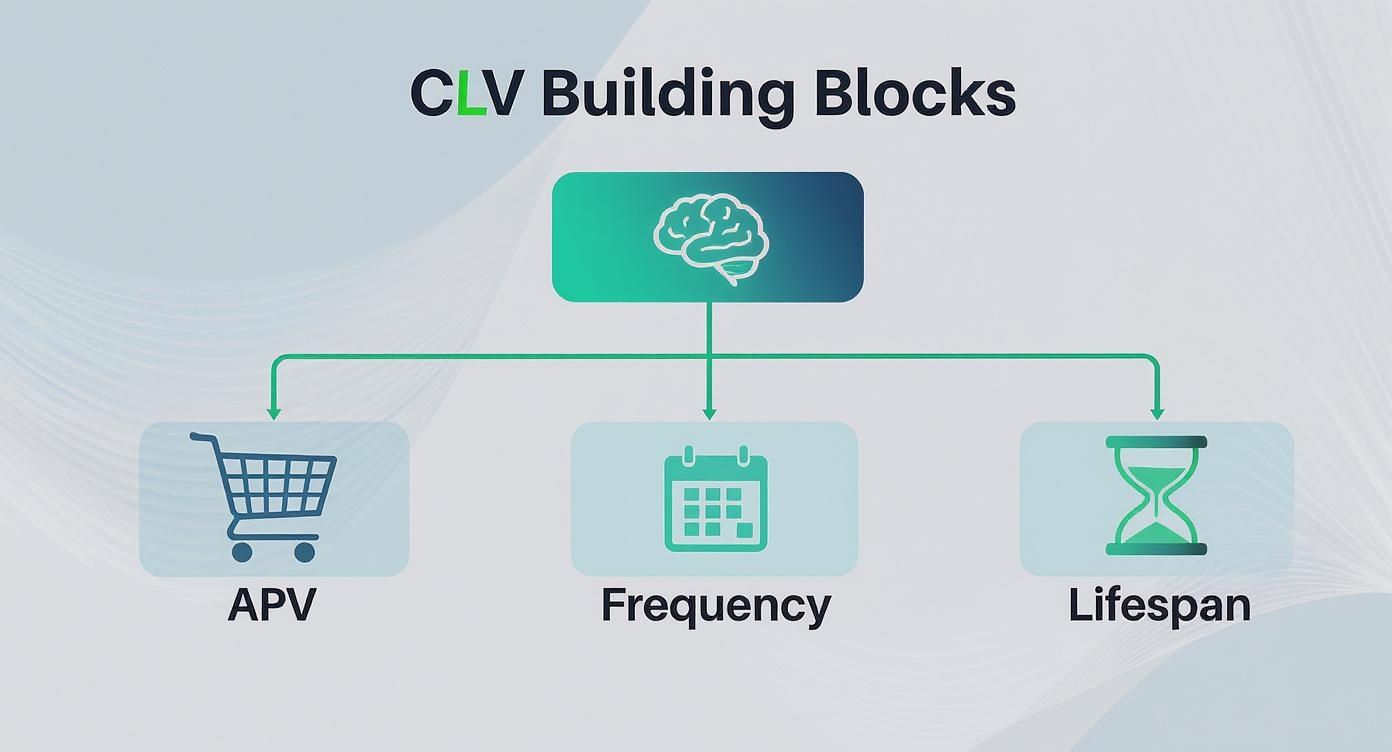

To really get a handle on customer lifetime value, you first need to know what goes into it. Think of CLV like a final recipe—the quality of your dish depends entirely on the ingredients you use. By breaking down the essential metrics that measure customer behavior and financial impact, you can start to see the complete picture of what a customer is truly worth.

Each component tells part of the story, from how much customers spend in a single visit to how long they stick around. Getting these individual pieces right is the first step toward building a powerful, predictive model for your business's future health.

The first key ingredient is Average Purchase Value (APV). This metric tells you, on average, how much a customer spends in a single transaction. It’s the average bill at your digital cash register.

Imagine you run an online store. Some people might buy a single $15 t-shirt, while others fill their cart with $300 worth of gear. Your APV smooths out these highs and lows to give you one reliable number. Calculating it is simple: just divide your total revenue over a certain period by the total number of orders in that same period.

A higher APV is a direct line to a higher CLV, making it a critical lever for growth. This is exactly why strategies like upselling, cross-selling, and product bundling exist—they're all designed to bump up this very number.

Next up is Purchase Frequency. This metric measures how often the average customer buys from you within a specific timeframe, like a month or a year. It's the rhythm of your customer relationships.

Let's say one customer buys from your supplement brand every month like clockwork (12 times a year), while another only stocks up during your big Black Friday sale (once a year). Purchase frequency captures this pattern of repeat business. A loyal, frequent customer is often far more valuable than someone who makes a single large purchase and then disappears forever.

This component is a massive indicator of customer loyalty and satisfaction.

A high purchase frequency suggests your products have become a regular part of your customers' lives, which is a powerful driver of long-term value.

Customer Lifespan is the average amount of time a person remains an active customer. It’s the total length of your relationship, from their first purchase to their last. This metric is tied directly to its inverse: the Churn Rate, which is the percentage of customers who stop buying from you over a given period.

A longer lifespan means more opportunities for purchases, creating a huge multiplier effect on CLV. If your average customer stays with you for three years instead of one, their potential lifetime value literally triples, assuming their spending habits stay the same. This is why reducing churn, even by a small percentage, can have such a massive impact on your overall revenue.

Finally, we have Customer Acquisition Cost (CAC). While it’s not technically part of the CLV formula itself, it provides absolutely essential context. CAC is the total amount you spend on sales and marketing to land one new customer.

A healthy business model demands a CLV that is significantly higher than its CAC. The classic rule of thumb is to aim for a CLV to CAC ratio of at least 3:1. This means for every dollar you spend to get a customer, you should expect to get at least three dollars back in lifetime value.

To get this right, you have to segment your customer base. Understanding what a user persona is is a great starting point for this, as it gives you a much clearer view of different customer groups. Grouping customers this way lets you perform a more detailed customer cohort analysis and pinpoint which segments are actually the most profitable to acquire.

Alright, let's move past the theory and get our hands dirty with some actual numbers. Calculating CLV is where you turn the abstract idea of a "customer relationship" into a hard, financial metric that you can actually use to make decisions. We'll kick things off with a simple, historical formula and then build our way up to more powerful predictive models.

This infographic breaks down the core building blocks—Average Purchase Value, Frequency, and Lifespan—that are the foundation of any CLV calculation.

As you can see, each piece builds on the last. When you put them all together, you get a full picture of what a customer is truly worth to your business over time.

The most straightforward way to start is with the historical model. This method uses past data to figure out what your customers have been worth so far. It’s a great entry point because it’s easy to calculate and uses numbers you probably already have sitting in your sales reports.

First, you figure out the average value a customer brings in over a specific period, like a year.

Customer Value (CV) = Average Purchase Value × Average Purchase Frequency Rate

Then, to get the full lifetime value, you just need to factor in how long they typically stick around as a customer.

CLV = Customer Value × Average Customer Lifespan

Let's make this real with a quick example.

Imagine you run a monthly subscription box called "SnackCrate" that costs $25. On top of that, most subscribers add an extra $5 worth of snacks to their order each month. This makes your Average Purchase Value (APV) $30.

Since your customers get a box every month, their Average Purchase Frequency Rate is 12 times a year.

Now, let's say your data shows that the average customer stays subscribed for 2.5 years. That's your Average Customer Lifespan.

Boom. Your historical CLV is $900. This tells you that, on average, every new subscriber you bring in is worth about $900 in revenue over their entire relationship with your brand.

The historical model is a solid start, but it has one big flaw: it assumes the future will look exactly like the past. Predictive CLV models give you a much more forward-looking (and accurate) picture by bringing in variables like customer churn and actual profit margins.

A more advanced—but still very manageable—predictive formula looks like this:

CLV = (Average Annual Profit per Customer × Average Customer Lifespan) - Customer Acquisition Cost

This version is way more powerful because it shifts the focus from revenue to profit, and it wisely subtracts the cost of getting that customer in the door.

Introducing profit margins and acquisition costs transforms CLV from a simple revenue metric into a true measure of profitability, providing a much clearer picture of your business's financial health.

To nail this kind of analysis, you absolutely have to get a handle on customer churn. Your churn rate—the percentage of customers you lose over a period—directly impacts your customer lifespan and is one of the most important indicators of business stability. If you want to get this right, it helps to first understand how to calculate customer churn before you dive headfirst into predictive models.

So, which formula is right for you? It really depends on your business stage, the data you have on hand, and how deep you're ready to go. Each approach offers a different level of accuracy and insight.

Here’s a quick comparison to help you choose the best fit for your current needs:

Ultimately, the goal here isn't just to calculate a number—it's to gain insights you can act on. Start with the simplest model, get comfortable with it, and then start layering in more complexity as your data and confidence grow.

Running a customer lifetime value analysis is like drawing a detailed treasure map. It shows you exactly where the most valuable opportunities are hiding in your customer base. But a map is useless if you don't follow it. The real magic of CLV happens when you turn those numbers into concrete actions that actually grow your business.

This process starts when you stop looking at CLV as a single, company-wide number. Instead, you'll use this data to slice your audience into meaningful groups, allowing you to tailor your marketing, sales, and service with surgical precision. By treating different customers differently based on their value, you can put your resources where they’ll make the biggest impact and build stronger, more profitable relationships.

The first—and most powerful—step is to segment customers into value tiers. This isn’t about ignoring anyone; it’s about recognizing that not all customers need the same level of attention. Think of it like an airline's loyalty program—everyone gets to their destination, but the frequent flyers get special treatment.

You can create simple but effective tiers like these:

By breaking down your customer base this way, you can build targeted campaigns that speak directly to their current relationship with your brand, making every touchpoint feel more relevant.

Your CLV data is built on purchase history, which is an absolute goldmine for personalization. You can use this information to create hyper-relevant experiences that make customers feel seen and understood. It's all about connecting past behavior to future offers.

For a high-value VIP in your e-commerce store, this could mean offering exclusive early access to new products similar to their past favorites. For an at-risk customer, you might send a targeted discount on a product they’ve viewed a few times but never bought.

CLV analysis gives you the blueprint for personalization at scale. It transforms marketing from generic broadcasts into tailored conversations, showing customers you understand their needs and preferences.

This level of detail also lets you optimize your marketing spend by focusing your budget on the segments most likely to respond, rather than burning cash on less engaged audiences.

The impact of focusing on customer value is crystal clear in the telecommunications world. Many providers are obsessed with acquisition, often overlooking the massive potential sitting right in their existing customer base. This is a costly mistake.

A global study found that telecom operators are often realizing only about 60% of their total customer value potential. In other words, they're leaving 40% of their revenue on the table. This happens because they fail to nurture high-value customers or re-engage those at risk of churning.

By running a CLV analysis, these companies can pinpoint subscribers with high lifetime value and proactively offer them loyalty rewards, personalized upgrade paths, or better service—drastically cutting churn and unlocking that missed revenue. This example proves that without a clear strategy informed by CLV, even major industries can miss out on huge growth opportunities. By shifting from a purely acquisition-focused mindset to one that balances new customers with retention, businesses can build a far more sustainable and profitable future.

The next big shift in customer lifetime value is already here, and it's all about moving from looking in the rearview mirror to seeing what's coming around the bend. Thanks to Artificial Intelligence, CLV analysis is no longer just a static report card on past performance. It’s becoming a dynamic, forward-looking compass for your entire business.

AI and machine learning models can chew through massive datasets—far more than any human team ever could—to find subtle patterns in customer behavior. They don't just see what a customer did; they can make a pretty sharp guess about what a customer is likely to do next.

This means AI can predict future purchases, flag customers who are at high risk of churning long before they show any obvious signs, and even recommend the specific action most likely to keep them around. It's a huge shift from the old reactive strategies. For a deeper dive into the tech making this possible, check out how AI is revolutionizing marketing strategies.

The real magic happens when this technology starts automating personalized experiences at scale. Forget clunky, manual segmentation. AI models can group customers on the fly based on their predicted lifetime value and behaviors.

Imagine a system that automatically pulls the right lever for the right person at the right time:

Predictive analytics turns customer lifetime value analysis into an active, intelligent system. It’s no longer just about understanding the past; it's about actively shaping a more profitable future.

This isn't some far-off sci-fi concept; it's quickly becoming the new standard. A Gartner report predicts that 85% of companies will soon use AI-driven models for CLV to make their marketing more agile. In fact, businesses already using AI are reporting an average 15% increase in retention and a 20% boost in overall CLV.

The tools to make this happen are available today, giving businesses a serious competitive edge. By weaving these capabilities into your workflow, you can create the kind of sophisticated, omnichannel experiences that build lasting relationships and maximize what every customer is worth.

To learn more, check out our guide on predictive analytics in marketing.

Even with a solid grasp of the formulas, a few practical questions always seem to pop up when teams first dive into customer lifetime value. Think of this as a quick FAQ section to clear up any of those lingering uncertainties. We'll tackle some of the most common sticking points we see businesses run into.

Getting these details sorted helps bridge the gap between knowing the theory and actually using it to make smarter business decisions.

While they sound almost the same, CLV and customer equity are looking at your business from two totally different altitudes.

Customer Lifetime Value (CLV) is a prediction of the future profit you'll get from a single customer relationship. It’s all about answering the question, "How much is this specific customer likely to be worth to us over their entire time with our brand?"

On the other hand, customer equity is the sum of the lifetime values of all your current and future customers. It’s a massive, big-picture metric that represents the total value of your entire customer base.

Think of it this way: CLV is like figuring out the future harvest potential of a single tree in your orchard. Customer equity is the total value of the entire orchard, including all the trees you have now and the ones you plan on planting.

There's no single right answer here—the best rhythm for calculating CLV really depends on your business model and how quickly things change in your industry. But here are a couple of solid guidelines:

The key is to find a cadence that gives you useful insights without creating a ton of extra work for your team.

You don't need a massive, perfectly clean data warehouse to get started with CLV analysis. If you're a small business, you can kick things off with a simple historical model. Just gather the data you almost certainly already have: total revenue, total number of orders, and a list of unique customers from the last year.

With that information, you can calculate your Average Purchase Value and Purchase Frequency. Even if you have to take an educated guess at your average customer lifespan to start, this basic calculation gives you an incredibly valuable baseline that you can refine and improve over time.

Ready to stop guessing which marketing efforts are driving your most valuable customers? Cometly is the all-in-one attribution platform that connects your ad spend directly to revenue, giving you the clarity needed to optimize your CLV. See exactly which campaigns attract high-value customers and scale what works with confidence. Learn more and get started at Cometly.

Learn how Cometly can help you pinpoint channels driving revenue.

.svg)

Network with the top performance marketers in the industry